Liquid and Shell Egg Market News

December 20, 2025

Source: USDA AMS Livestock & Poultry Program, Livestock, Poultry, and Grain Market News Division Egg Markets Overview

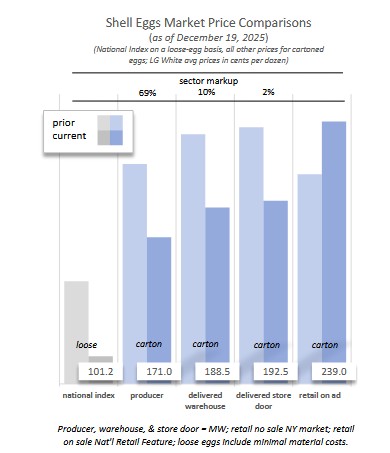

SHELL EGG HIGHLIGHTS

Source: USDA AMS Livestock & Poultry Program, Livestock, Poultry, and Grain Market News Division Egg Markets Overview

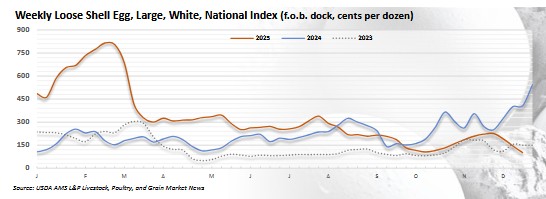

Negotiated wholesale prices for graded loose caged eggs are sharply lower with a lower

undertone remaining. Demand is mostly light to moderate for carton and loose stock and

slowing as needs for the holiday demand season are met. Offerings and supplies are

moderate to available and trading is slow headed into the holiday weekend.

CAGE FREE

The California benchmark for Large shell eggs decreased $0.46 to $2.45

per dozen with a weak undertone. Delivered prices on the California-compliant wholesale

loose egg market declined $0.69 to $1.11 per dozen with a lower undertone. Demand is

light to moderate for light to moderate offerings and moderate to fully adequate supplies.

Trading is slow. Cage-free stock accounted for 38% of

eggs processed last week, down one percent in share. Production of whole egg decreased

5% while production of whites was up 7% and of yolks up 5%. Dried egg production

increased 7% and production of inedible egg was up 8%.

LIQUID EGG HIGHLIGHTS

Wholesale prices for certified liquid whole eggs are too few to publish with a lower

undertone on light to moderate demand and moderate to available offerings. Supplies are

moderate to ample and trading is mostly slow. Wholesale prices for frozen eggs are too

few to publish with frozen whole last quoted at $1.25 per pound and frozen whites at

$1.17 per pound.

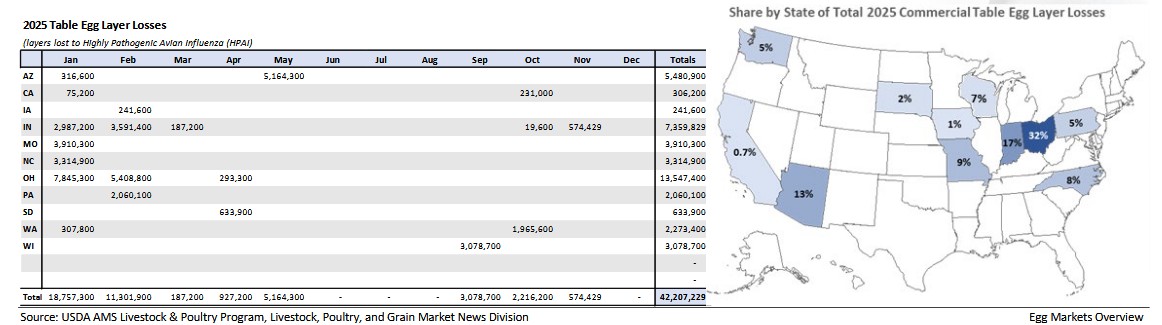

HIGHLY PATHOGENIC AVIAN INFLUENZA (HPAI) UPDATE

No new outbreaks of highly pathogenic avian influenza (HPAI) in commercial table eggs

flocks were reported this week. In 2025 to date, based on the latest data from APHIS, HPAI

in commercial table egg layer flocks have resulted in the depopulation of 42.2 million

birds. To date, USDA APHIS has confirmed 73 outbreaks in layer flocks in 11 states (AZ,

CA, IA, IN, MO, NC, OH, PA, SD, WA, and WI).

The 42.2 million birds lost included 24.7 million (58.4%) in conventional caged systems

and 17.6 million (41.6%) in cage-free systems. These losses represent 13.5% of the

conventional caged layer flock and 17.4% of the non-organic cage-free flock on January

1, 2025. Compared to January 1, the caged flock on September 1 was down 9.5% while the cage-

free flock was up 15.5% and the organic table egg flock was down 1.9%.

Source: USDA Egg Market News

|

Website Powered by BannerOS. Your Business Energized!

Website Powered by BannerOS. Your Business Energized!