Cheese and Butter Market Update

December 20, 2025

National Dairy Products Highlights

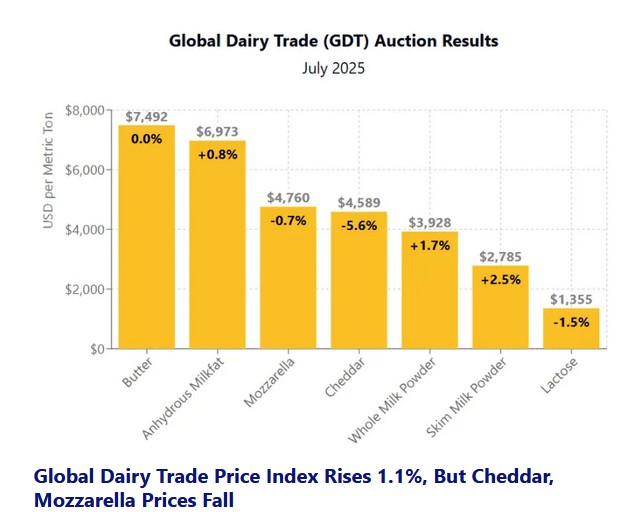

Cheddar: The average winning price was $4,646 per metric ton ($2.11 per pound), unchanged. Average winning prices were: Contract 1 (January), $4,627 per ton, down 1.0%; Contract 2 (February), $4,646 per ton, up 1.2%; Contract 3 (March), $4,633 per ton, down 0.5%; Contract 4 (April), $4,678 per ton, down 0.8%; and Contract 5 (May), $4,645 per ton, up 1.1%.

During 2025, the average Cheddar price on the GDT auctions ranged from a low of $4,328 per ton at November’s second auction to a high of $5,519 per ton in May’s first auction.

Mozzarella: The average winning price was $3,395 per ton ($1.54 per pound), up 6.7%. Average winning prices were: Contract 2, $3,391 per ton, up 6.5%; and Contract 3, $3,400 per ton, up 6.9%.

During 2025, the average Mozzarella price on the GDT auctions ranged from a low of $3,182 per ton at December’s first auction to a high of $4,897 per ton at June’s first auction.

Skim milk powder: The average winning price was $2,431 per ton ($1.10 per pound), down 2.1%. Average winning prices were: Contract 1, $2,439 per ton, down 2.0%; Contract 2, $2,414 per ton, down 2.0%; Contract 3, $2,429 per ton, down 2.4%; Contract 4, $2,464 per ton, down 2.7%; and Contract 5, $2,507 per ton, down 0.8%.

During 2025, the average skim milk powder price on the GDT auctions ranged from a low of $2,431 per ton at this week’s auction to a high of 2,876 per ton at April’s first auction.

Whole milk powder: The average winning price was $3,161 per ton ($1.43 per pound), down 5.7%. Average winning prices were: Contract 1, $3,146 per ton, down 5.7%; Contract 2, $3,136 per ton, down 6.4%; Contract 3, $3,176 per ton, down 5.2%; Contract 4, $3,199 per ton, down 5.1%; and Contract 5, $3,304 per ton, down 3.1%.

During 2025, the average whole milk powder price on the GDT auctions ranged from a low of $3,161 per ton at this week’s auction to a high of $4,374 per ton at May’s first auction.

Butter: The average winning price was $5,012 per ton ($2.27 per pound), down 2.5%. Average winning prices were: Contract 1, $4,958 per ton, down 2.8%; Contract 2, $4,993 per ton, down 2.3%; Contract 3, $5,005 per ton, down 2.5%; and Contract 4, $5,200 per ton, down 3.3%.

During 2025, the average butter price on the GDT auctions ranged from a low of $5,012 per ton at this week’s auction to a high of $7,992 per ton at May’s first auction.

USDA Lowers 2026 Milk Production, Cheese And Butter Price Forecasts

Washington–The US Department of Agriculture (USDA), in its monthly supply-demand estimates released Tuesday, lowered its milk production forecast for 2026 and also lowered its cheese and butter price forecasts for 2026.

The milk production forecast for 2025 is unchanged from last month, at 231.4 billion pounds, which would be 5.5 billion pounds higher than 2024 output. For 2026, the milk production forecast is lowered by 200 million pounds from last month, to 234.1 billion pounds, on reduced cow inventories more than offsetting a higher rate of growth in milk per cow.

USDA’s butter price forecast for 2025 is raised by one-half cent from last month, to $2.2250 per pound, on prices reported through November. The cheese price forecast for 2025 is lowered by 1.0 cent from last month, to $1.7950 per pound, on recent price weakness. The nonfat dry milk and dry whey price forecasts are unchanged for 2025, at $1.1700 per pound and 59.50 cents per pound, respectively.

Also for 2025, Class III price forecast is lowered 5 cents from last month, to $1.7950 per hundredweight, while the Class IV price is raised by 5 cents, to $17.40 per hundred. The all milk price is lowered by 5 cents, to $21.00 per hundred.

For 2026, the cheese and butter price forecasts are lowered from last month as price weakness in late 2025 is expected to carry into 2026. The 2026 dry whey price is raised on strong demand continuing into next year, while the nonfat dry milk price forecast is unchanged.

USDA’s new 2026 product price forecasts, with comparisons to last month’s forecasts, are as follows: cheese, $1.6750 per pound, down 6.5 cents; butter, $1.6750 per pound, down 2.5 cents; dry whey, 63.50 cents per pound, up 1.5 cents; and nonfat dry milk, $1.1700 per pound, unchanged.

Class III and Class IV prices for 2026 are lowered, by 60 cents to $17.05 per hundred and by 10 cents to $14.40 per hundred, respectively. And the all milk price is lowered by 50 cents, to $18.75 per hundred.

The dairy import forecast for 2025 is lower on a fat basis, mainly due to less expected butter imports, and unchanged on a skim-solids basis. Dairy exports for 2025 on a fat basis are raised with US butter continuing to be competitive in international markets. Dairy exports are unchanged on a skim-solids basis for 2025.

For 2026, fat basis imports are lowered primarily on reduced demand for imported butter products. Skim-solids basis imports are raised slightly. Exports are raised on a fat basis for 2026 due to additional shipments of butter. Skim-solids basis exports are lowered due to fewer shipments of skim milk powder products.

Sources: USDA Dairy Market News and Cheese Reporter CME Butter and Cheese

|

Website Powered by BannerOS. Your Business Energized!

Website Powered by BannerOS. Your Business Energized!