Liquid and Shell Egg Market News

May 23, 2025

Source: USDA AMS Livestock & Poultry Program, Livestock, Poultry, and Grain Market News Division Egg Markets Overview

SHELL EGG HIGHLIGHTS

Source: USDA AMS Livestock & Poultry Program, Livestock, Poultry, and Grain Market News Division Egg Markets Overview

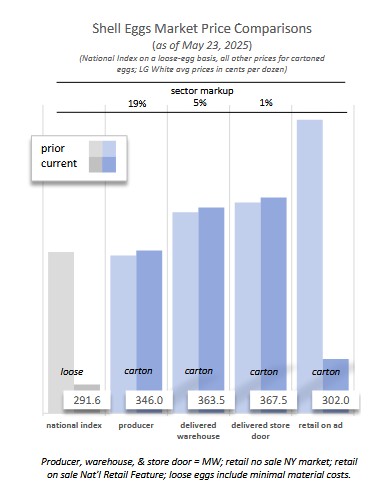

Negotiated wholesale prices for graded loose caged eggs are weak to sharply lower on

light to moderate demand and moderate supplies. Trading is slow to moderate.

Wholesale prices for national trading of trucklot quantities of graded, loose, White Large

shell eggs decreased $0.54 to $2.92 per dozen with a weak undertone. The wholesale price

on the New York market for formula trading of Large cartoned shell eggs delivered to

retailers decreased $0.45 to $3.30 per dozen with a weak undertone. In the major Midwest

production region, wholesale prices for Large, white, shell eggs delivered to warehouses

gained $0.02 to $3.64 per dozen with a steady undertone as did prices paid to producers

for Large cartoned shell eggs at $3.46 per dozen. The California benchmark for Large shell

eggs declined $0.27 to $4.55 per dozen with a weak undertone. Delivered prices on the

California-compliant wholesale loose egg market declined $1.87 to $2.58 per dozen with

a weak undertone. Interest is light for light to moderate offerings and moderate supplies.

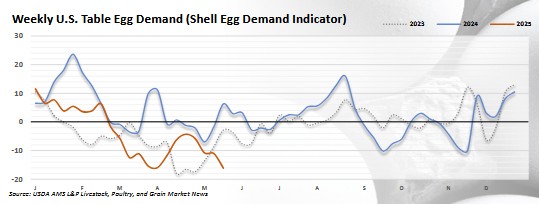

Demand for shell eggs moved lower over the past week as movement into consumer

marketing channels slowed. Everyday prices for shell eggs in grocery outlets have come

down as the avian influenza crisis has waned and supplies have recovered but are yet to

reach a level to incentivize shoppers to purchase much beyond basic week-to-week needs.

However, as Memorial Day arrives this weekend, marking the unofficial start of summer

and backyard gatherings, some major grocers are featuring shell eggs in their store

circulars at some of the most attractive price levels since prior to the start of the supply

shortages earlier this year – levels almost certain to stimulate consumption. Demand for

shell eggs from egg products manufacturers slowed this week as increased spot market

offerings and reduced schedules provided an opportunity to increase stocks to their

highest level in a month. Demand is expected to remain light as schedules are varied

headed into the holiday weekend.

CAGE FREE

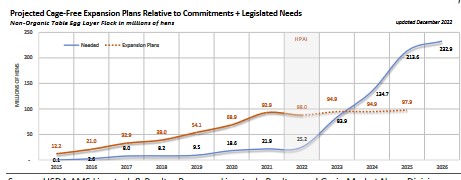

As of July 2024, cage-free commitments remain about unchanged, requiring an estimated

66.7 billion cage-free eggs per year to meet 100% of needs from an approximate cage-

free flock of 221.4 million hens (72.7% of the U.S. non-organic flock), indicating a shortage

of 121 million hens from the current non-organic cage-free flock of 100.7 million hens.

The average lay rate for non-organic, barn/aviary cage-free production for the month is

estimated at 82.6%.

LIQUID EGG HIGHLIGHTS

Wholesale prices for certified liquid whole eggs are lower with a weak undertone. Demand

is moderate to very good for light to moderate offerings and supplies. Trading is

moderate to active. Wholesale prices for whole frozen eggs are down $0.20 to $3.00 per

pound while prices for frozen whites declined $0.25 to $2.40 per pound. The undertone

is mostly weak with a full range of demand. Offerings are light and supplies are light to

moderate. Trading is moderate. Prices for dried eggs are too few to report this week. The

price of dried whole egg was tested last week at $25.00 per pound, dried yolk at $21.00

per pound, and dried albumen at $30.00 per pound. The undertone is generally weak with

light to moderate demand. Offerings and supplies are light to very light and trading is

moderate.

Source: USDA Egg Market News

|

Website Powered by BannerOS. Your Business Energized!

Website Powered by BannerOS. Your Business Energized!