|

VENTURA NEWS & VIEWS

December 27, 2022

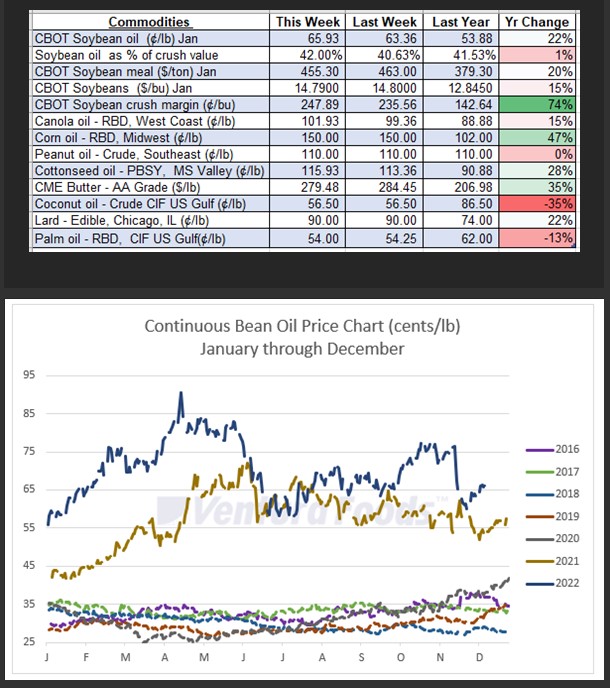

Edible Oil Market Summary

Soybean Oil Summary

Dry weather in Argentina and southern Brazil continues to lend support to the soybean complex and helped contribute to a 4% gain in CBOT soybean oil futures this week. While some rain has fallen in Argentina over the last couple of weeks, precipitation forecasts into early January remain mixed which may further erode soybean condition ratings that are already well below the 5-year average. On the demand front, a surge in COVID cases in China could keep demand suppressed enetering 2023 as economic activity struggles to bounce back. Choppy, two-sided trade is expected through the holidays. The market will be looking for further guidance from the USDA’s upcoming quarterly stocks report (December 31st) and the January WASDE (January 12th).

Canola Oil Summary

Canola seed futures started the week down 2% but clawed back the early losses and posted a gain of 1% on the week. Technical factors have limited upside price risk while slow farmer selling has provided underlying support to prices, keeping the market in a tight rangebound pattern. Canola markets will continue to keep an eye on the soybean complex as continuing deterioration of soybean condition ratings in Argentina could support the broader oilseed market.

Palm Oil Summary

With nearly 18% of China’s population contracting COVID in the first 20 days of December, any palm oil demand impacts expected from their reopening is sure to be muted over coming weeks. It is becoming more likely that the market will miss the pre-Chinese New Year surge in buying that is typical for this time of year and could keep palm prices within their recent range in the short term. Continued flooding in Malaysia is creating supply disruptions in the world’s 2nd largest palm producing nation with not only lower palm production but also deteriorating quality. Exports from Malaysia during Dec 1-20 fell -4.5% vs November with aggressive offers out of Indonesia biting into Malaysian business. Malaysian palm stocks look to close out 2022 near 2.2 mil MT, a solid number, while Indonesian stocks will end the year below 3 mil MT which is considered low. Palm oil is likely to continue to be a follower of soy oil and energy prices over the next 30 days.

Source: Ventura Foods News & Views

|

Website Powered by BannerOS. Your Business Energized!

Website Powered by BannerOS. Your Business Energized!